Examining outcomes associated with Social Security Scotland spending: an evidence synthesis

Social Security Scotland now delivers 14 benefits that support around 1.2 million people in Scotland. This report synthesises evidence relating to the outcomes associated with social security spending administered by Social Security Scotland, and highlights opportunities for further research.

3. Background

The Scotland Act 2016 devolved new powers over social security to the Scottish Parliament and gave the Scottish Government the power to create new benefits and top up existing ones[19]. The first wave of benefits was announced in May 2017 along with the intention to create a new agency, Social Security Scotland, to deliver the devolved benefits.

The Social Security (Scotland) Act 2018 sets out the framework for the operation of devolved social security powers, and identifies eight overarching principles for how the system will operate. It also commits the Scottish Government to produce a Social Security Charter setting out what people should expect from the new social security system. The Charter[16] was produced in partnership with people with lived experience of social security benefits and organisations that represent them.

Distinguishing characteristics of Scottish social security benefits

Social Security Scotland is an executive agency created by the Scottish Government to administer the Scottish social security system effectively, in accordance with the principles in the 2018 Act and Charter. The new system takes a human rights approach that seeks to address the perceived adversarial nature of the previous system, replacing it with a new, distinctly Scottish system founded on dignity, respect, and human rights[20].

The overarching aim for social security in Scotland as set out in ‘Creating a Fairer Scotland: a new future for social security in Scotland’[21] is ‘to create a fairer society’.

This is described in relation to objectives such as:

- Tackling poverty and inequality

- Helping people move into or stay in work and participate in society

- Providing protection and acting as a safety net in times of need

- Acting as early intervention to give people the best possible chances in life

- Treating people with dignity and respect, reducing stigma and maximising benefit take up

An updated Social Security Programme Business Case was published in February 2023[22]. The Scottish Government has committed £5.3 billion in social security spending in 2023-24, which is forecast to rise to £8.0 billion in 2028-29[1], supporting around two million people[23]. This spending represents a deliberate choice by the Scottish Government to use its social security powers to help low-income families and carers with their living costs and to tackle poverty. The devolved disability benefits aim to help mitigate the increased costs people incur as a result of having a disability or long term health condition.

Examples of the Scottish Government’s new approaches to benefits include: abolishing routine face to face assessments for disability benefits; introducing indefinite awards for some disabled people where their disability or condition is very unlikely to change, to avoid the need for them to undergo unnecessary reviews; replacing food vouchers that people said they found stigmatising with Best Start Foods (BSF) payment cards which can be used like regular debit cards, and a series of Benefits Take-up Strategies[24] which aim to ensure that everyone gets the support to which they are entitled.

Figure 1 below sets out a timeline for delivering devolved benefits. This demonstrates the considerable pace at which new benefits have been introduced in Scotland over the last 5 years.

Figure 1: The timeline for delivering the devolved benefits

2018

- Carer's Allowance Supplement (grey)

- Best Start Pregnancy & Baby Payment (green)

2019

- Best Start Early Learning Payment (green)

- Best Start School Age Payment (green)

- Best Start Foods (green)

- Young Carer Grant (grey)

- Funeral Support Payment (green)

2020

- Job Start Payment (green)

- Child Winter Heating Payment (orange)

2021

- Scottish Child Payment (green)

- Child Disability Payment (orange)

2022

- Adult Disability Payment (orange)

2023

- Winter Heating Payment (green)

- Carer Support Payment (grey)

Benefits in green are low-income benefits with an earnings threshold, benefits in grey are carer benefits, and benefits in orange are disability benefits.

Benefits included in this evidence synthesis

Evidence relating to all benefits delivered by Social Security Scotland was reviewed and the devolved benefits included in this evidence review are summarised in Table 1 below by type.

The value and frequency of payments varies considerably across benefits ranging from a one-off annual payment of £55.05 (Winter Heating Payment) to a weekly payment of up to £172.75 (for Adult Disability Payment or Child Disability Payment). An overview of each benefit including eligibility, payment amount and estimates of take up is provided in Annex A.

Table 1: Characteristics of benefits delivered by Social Security Scotland

Low income benefits (Earnings thresholds apply)

- Scottish Child Payment*

- Best Start Foods*

- Best Start Grant Pregnancy & Baby Payment

- Best Start Grant Early Learning Payment

- Best Start Grant School Age Payment

- Funeral Support Payment

- Job Start Payment

- Winter Heating Payment

Disability benefits (No earnings thresholds apply)

- Adult Disability Payment*

- Child Disability Payment*

- Child Winter Heating Payment

Carer benefits

- Young Carer Grant (no earnings threshold)

- Carer’s Allowance Supplement (earnings threshold)

*Indicates a regular four-weekly payment. Other payments are made once (YCG, CWHP, WHP) or twice (CAS) a year, or on a one-off basis (BSG, FSP, JSP).

Distribution of social security spending across benefits

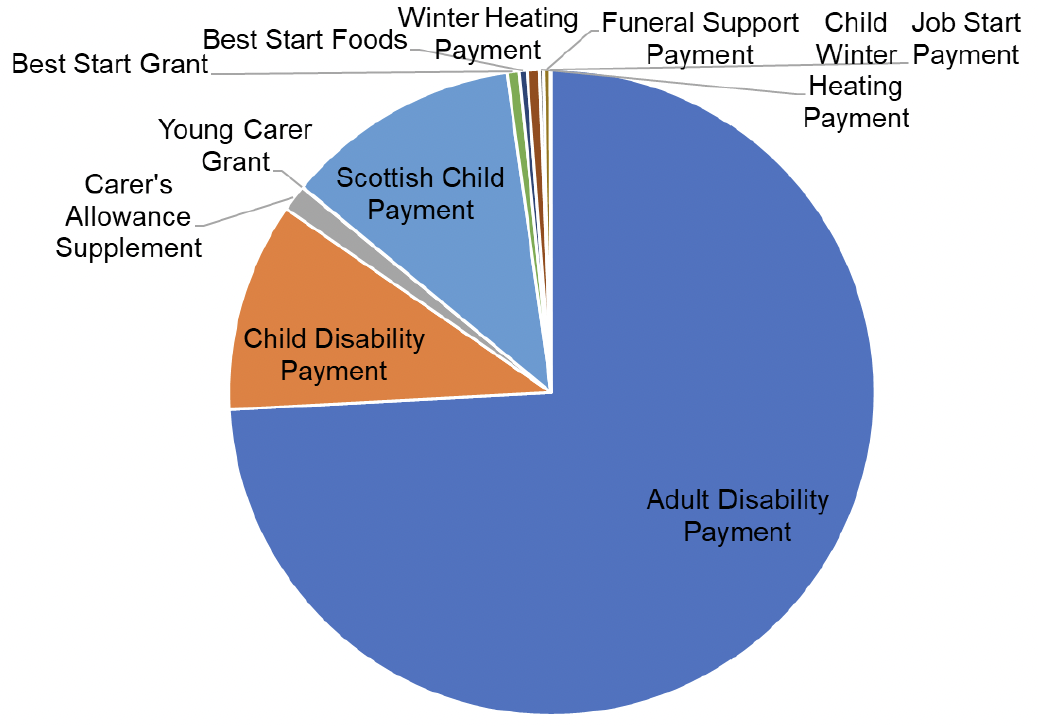

In 2023-24, around 85% of total forecast spending[1], [25] on the 11 devolved benefits considered in this evidence synthesis is accounted for by two disability benefits, Adult Disability Payment (74.2%) and Child Disabilty Payment (10.5%) as shown in Figure 2 below. Disability payments are designed around the social model of disability to recognise the extra costs associated with being disabled, given the barriers that society creates for disabled people. Eligibity is therefore not subject to earnings thresholds in the same way as for low-income benefits.

The majority of social security expenditure can be considered as driven by the prevalance of disability and ill health in the population. Rates of disability and long term health conditions are increasing across all nations of the UK and therefore the funding received from the UK Government for devolved disability benenfits through block grant adjusments is also increasing. However, the forecast spend trajectory for disability benefits is steeper in Scotland according to the most recent Scottish Fiscal Commission (SFC) forecasts[1] and the exact contribution of several possible factors is currently uncertain. The SFC, however, acknowlege high levels of uncertainty in current forecasts, particularly for Adult Disability Payment[1]. SCP accounts for a further 11.8% of benefit expenditure in 2023-24, with the remaining eight benefits collectively accounting for 3.5% of forecast spend.

Sources: Scottish Fiscal Commission Forecast, December 2023[1] and Scottish Government[25])

The SFC forecasts that total Scottish Social Security expenditure will increase from £4.2 billion in 2022-23 to £8.0 billion in 2028-29, of which around 80% will be on disability payments. The share of spending accounted for by disability payments would be even greater if the knock-on effects of rising disability leading to rising spending on carer benefits is considered. Policy decisions that affect the eligibilty criteria for different benefits, the Scottish Government’s approach to promoting benefit take up, and the economic cycle, can also influence levels of social security spending.

Contact

Email: Tom.Lamplugh@gov.scot

There is a problem

Thanks for your feedback