Economic impact of spending on social security - Technical note

This report provides an illustration of potential economic benefits from the Scottish Government's decision to increase social security expenditure.

Illustrative Economic Impacts

Short-term

In 2024-25, the Scottish Government will invest a record £6.3 billion in new and devolved social security benefits to support the most vulnerable in our society. This is £1.1 billion more than the UK Government allocation to the Scottish Government for social security as part of the fiscal framework.

We use a fiscal multiplier approach to consider the short-term impacts this additional social security spending could have on Scottish GDP. This is the same methodological approach that the Office for Budget Responsibility (OBR) use in their short-term demand side analysis of UK Government policy changes.

For example, as can be seen in Table 1, the OBR estimate that the short-term economic impact of increasing spending on areas of Annual Managed Expenditure (AME), which includes most social security spend at the UK Government level, tends to have a higher short-term economic impact relative to changes to resource spending (RDEL), or tax.

| Impact of a one per cent of GDP increase in category on real GDP | ||||||

|---|---|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | |

| Tax | 0.33 | 0.30 | 0.23 | 0.14 | 0.05 | 0.00 |

| RDEL | 0.34 | 0.31 | 0.22 | 0.10 | 0.03 | 0.00 |

| CDEL | 1.00 | 0.83 | 0.43 | 0.23 | 0.07 | 0.00 |

| CJRS | 0.15 | 0.14 | 0.11 | 0.06 | 0.02 | 0.00 |

| Other AME | 0.60 | 0.57 | 0.43 | 0.23 | 0.07 | 0.00 |

Source: Office for Budget Responsibility: Economic and Fiscal Outlook, November 2020, Box 2.1

Applying these multipliers suggests that the additional £1.1 billion of social security spending could result in a £300 million boost to Scottish GDP in the short term (in 2024-25 prices).

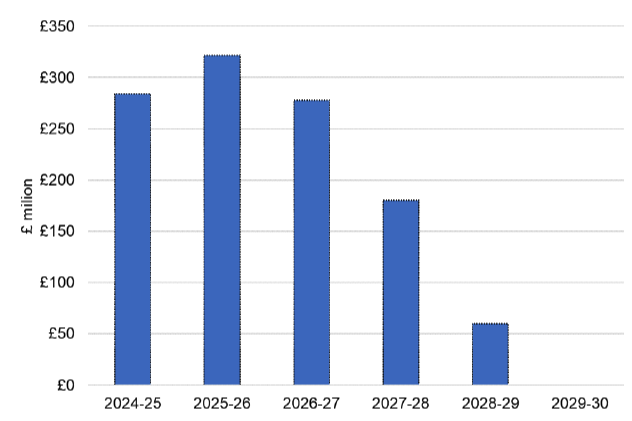

As can be seen in Figure 1, this impact is primarily focused on the short-term. The economic impact fades over time as the policies cause prices in the economy to adapt, such as the level of inflation or wages, which then results in a tapering of the economic impact back to zero over time.

Source: SG Analysis using Office for Budget Responsibility (OBR) fiscal multipliers

Long-term

As well as short-term impacts, social security spend can help deliver long-term improvements to the Scottish economy, through delivering positive supply-side improvements in the labour market. Through supporting people into the labour market and to find good, well paid, rewarding jobs, such programmes can help provide lasting change.

Scottish Government labour market and housing policies are expected to support more people into employment, while social security, childcare and labour market policies have the potential to reduce barriers to participation, particularly for disadvantaged groups.

Relatively small increases in participation can have positive impacts on economic performance. Illustrative modelling suggests that if we can increase labour force participation by around 0.25 percentage points this could boost GDP by around £180 million a year over the long-term (in 2024-25 prices). This underlines the importance of measures that increase labour market participation.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback