Economic impact of spending on social security - Technical note

This report provides an illustration of potential economic benefits from the Scottish Government's decision to increase social security expenditure.

Annex A – Modelling Assumptions

Short-term

We have used a fiscal multipliers approach to measure the impact of social security policies on the Scottish economy. Fiscal multipliers measure the short-term impact of discretionary fiscal policy on output. They are usually defined as the ratio of a change in output to an exogenous change in fiscal policy. This approach is used by a range of bodies that draw heavily on a range of academic research around this topic.

The additional social security spending is estimated as the difference between total Scottish Government social security spending and the social security block grant adjustment, as set out in the latest Scottish Fiscal Commission forecasts.[3] As shown in the table below, this is around £1.1 billion in 2024-25, rising to £1.5 billion in 2028‑29.

| 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|---|---|

| Total social security spending | 6,283 | 6,861 | 7,253 | 7,616 | 7,999 |

| Social security BGA | 5,191 | 5,625 | 5,931 | 6,231 | 6,497 |

| Additional social security spending | 1,092 | 1,236 | 1,322 | 1,385 | 1,502 |

To translate this into an impact on the economy, we apply fiscal multipliers used by the OBR, which are shown in the table below. There is obviously a range of uncertainty around these estimates. The OBR note that their fiscal multipliers have been drawn from the empirical literature. The OBR review their multipliers periodically, with the latest multipliers published as part of their November 2020 Economic and Fiscal Outlook.[4]

| 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 | |

|---|---|---|---|---|---|---|

| Tax | 0.33 | 0.3 | 0.23 | 0.14 | 0.05 | 0 |

| RDEL | 0.34 | 0.31 | 0.22 | 0.10 | 0.03 | 0 |

| Other AME | 0.60 | 0.57 | 0.43 | 0.23 | 0.07 | 0 |

The analysis assumes that the increase in social security is not funded by borrowing, reflecting the Scottish Government’s powers. This means that any additional social security spending would have to be financed by either increased taxation or reprioritising spending within the Scottish Government budget. We consider both approaches below.

We assume that the tax multiplier is a reasonable approximation for Scottish tax changes, that the RDEL multiplier is a reasonable approximation for Scottish resource spend, and that Other AME, which is primarily welfare expenditure, is a reasonable approximation for Scottish social security spending. The changes are expressed as a share of GDP using the Scottish Fiscal Commission’s December 2023 Economic and Fiscal Forecasts, and the multipliers are applied to these. The resulting impact on GDP is shown in the table below.

| Source of finance | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 |

|---|---|---|---|---|---|---|

| Tax | £295 | £334 | £264 | £125 | £30 | £0 |

| RDEL | £284 | £321 | £278 | £180 | £60 | £0 |

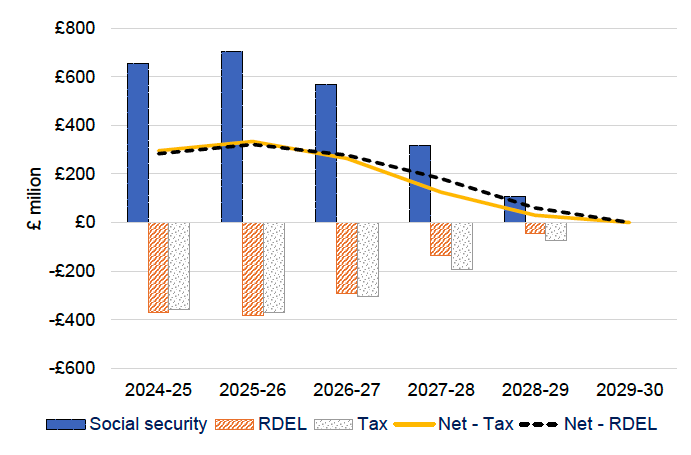

This shows that the source of funding has a relatively minor impact on the results. In both cases, the additional social security provides a short-term impact averaging around £300 million from 2024-25 to 2026-27. Figure A.1 below shows separately the positive impacts of increasing social security spending, the partially offsetting impacts of funding this by either taxation or resource spending, and the net effect.

Source: SG Analysis using Office for Budget Responsibility (OBR) fiscal multipliers

Long-term modelling

We have used the Scottish Government’s Global Econometric Model (SGGEM) to perform an illustrative scenario analysis on how a change in labour market participation could impact the Scottish economy.

SGGEM is an economic model that was commissioned from the National Institute of Economic and Social Research (NIESR) and one of its strengths is that it is a modified version (splitting the UK into Scotland and the rUK) of NIESR’s own Global Macroeconomic Model NiGEM,[5] which is an internationally recognised and scrutinised macroeconomic model which has been used by institutions such as the OECD, European Central Bank and the Bank of England. Consequently, the model is a well-developed general equilibrium model that is well suited to examining the macro-economic impact of various scenarios, including changes in the labour market.

An illustrative shock is calibrated to the model to increase the participation rate of individuals aged 16+ in Scotland by 0.25 percentage points. As this is an illustrative scenario analysis, no other assumptions or shocks are applied. It is assumed that fiscal policy and monetary policy in the model remain endogenous – in other words, they will react and adapt to the effects of the change. However, given the size of the shock is relatively small it does not have a significant effect. Additional sensitivity scenarios were run where monetary Policy and fiscal Policy are held exogenous and it does not materially alter the results.

The illustrative modelling suggests that permanently raising the participation rate by 0.25 percentage points could result in the overall size of the economy being around 0.1 per cent higher over the long-term. This would be equivalent to around £170 million in 2022 prices based on the latest published National Accounts, or alternatively around £180 million in 2024-25 prices using recent GDP forecasts.

Office of the Chief Economic Adviser

Scottish Government

March 2024

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback